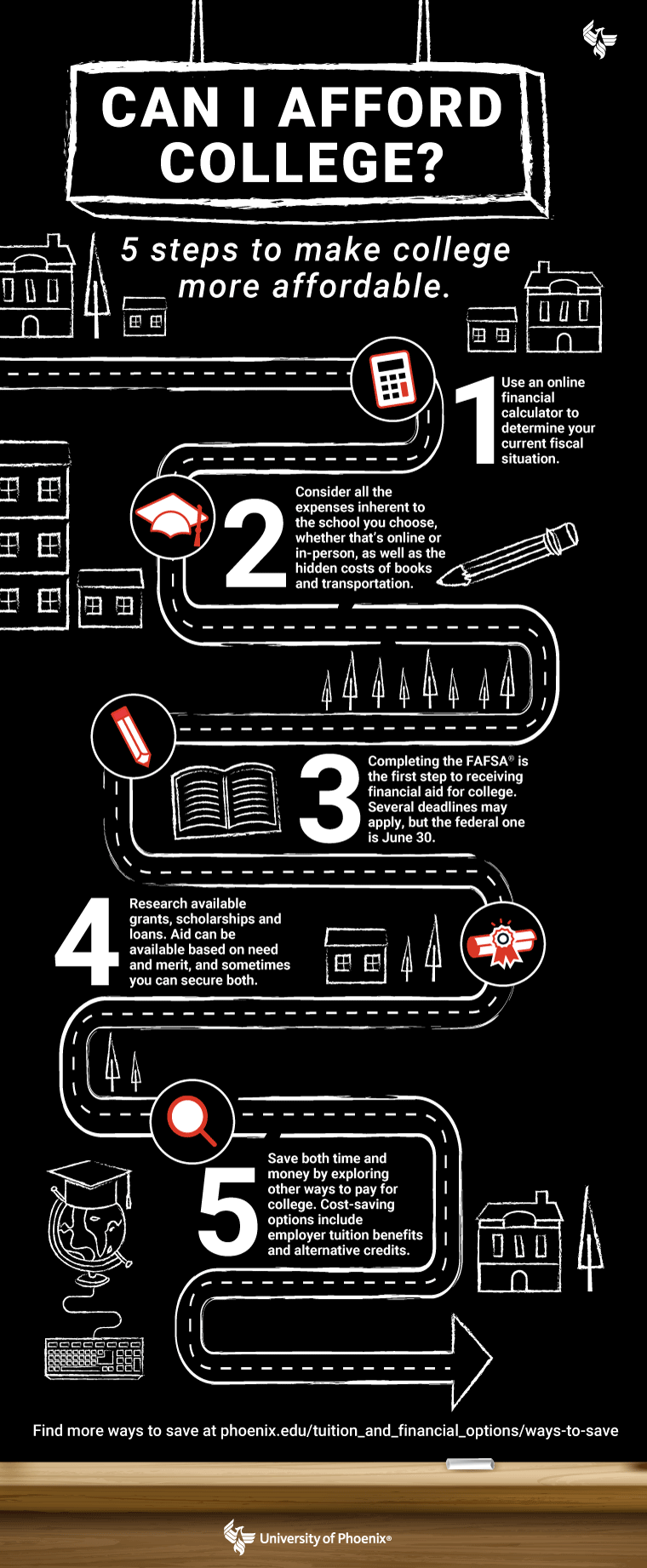

Can I afford college? A 5-step visual journey

This article was updated on May 23, 2024.

By Elizabeth Exline and Lilia Ortiz

Reviewed by Bronson Ledbetter, MBA, Vice President, Student Services and Financial Operations

If ever there were a time to have an accurate crystal ball, it would be when you needed to figure out if you could swing the cost of college . More than any other question — the where, the why, the how — it is this issue of affordability that can impact a person’s decision to pursue higher education.

In the absence of such an oracle, however, we offer the next best thing: a step-by-step guide to determining whether or not college is in your financial future.

Step 1: Crunch the numbers

Unless you already have a solid handle on your fiscal situation, it’s time to either sit down with pencil and paper to document your personal profits and losses or leverage a financial calculator to better understand how paying for college might impact your finances.

A simple internet search will yield a lot of options for online calculators. You can choose one for general financial planning or one specifically for saving for college

to gain a clearer understanding of the prospective financial impact.

If you have a particular school in mind, you can also reach out virtually or in person to ask for planning guidance. At University of Phoenix (UOPX), for example, prospective students can utilize an online calculator to estimate the cost of attendance.

As you figure out what you can reasonably afford and what you might need to borrow or earn in grants or scholarships, bear in mind that the cost of college is an investment in your future. College graduates not only earn more than those with less education, they also enjoy lower unemployment rates.

Still not sure about the actual numbers? A general "rule of thumb," according to Forbes.com , is that your projected salary should be at least 1.5 times more than the total amount you borrow.

Step 2: Find the right (affordable) college

In state or out of state. Four-year university or community college. Online or in-person. When it comes to choosing the right destination for your higher education , you have options.

Generally speaking, online colleges offer the advantage of reduced non-tuition costs. If you attend an in-person university, for example, you may have to pay for room and board, transportation, parking and so on. And all schools require educational materials, although some digital formats can be cheaper than traditional textbooks.

Step 3: Fill out the FAFSA®

Short for Free Application for Federal Student Aid , the FAFSA® is your best friend when it comes to sourcing free money for college. This is true if you’re hoping to secure federal student aid, as well as if you’re pursuing grants or loans from either the state or your chosen school (or both).

States and colleges have their own deadlines for the FAFSA® form, but the federal deadline is June 30 of each academic year.

Also, it bears repeating: Pay attention to the details. Read the instructions … twice. Sometimes the difference between getting aid and not is a matter of ticking the right box.

Once you’ve completed the FAFSA®, you can better estimate the cost of college as it pertains to you: You should receive an email detailing what you’ll qualify for in the way of federal grants and loans.

Step 4: Research available grants, scholarships and loans

The most common federal grants are Pell grants , which are for undergraduate students who have a demonstrable financial need, and Federal Supplemental Educational Opportunity Grants

, which are for undergrads who have "exceptional financial need" and are pursuing their first bachelor’s degree.

And, of course, since most grants don’t need to be repaid, these are worth pursuing. (There are eligibility requirements for grants, though!)

Scholarships , meanwhile, offer another welcome avenue to securing funds for college. Like grants, scholarships don’t usually need to be repaid, and they can be based on need or merit.

Get online to begin searching for scholarships that may apply to you. There are all manner of options, from scholarships for mothers to scholarships for people with certain ethnic backgrounds.

Schools also offer scholarships to prospective students. UOPX, for example, offers up to $1 million in scholarships this month. It’s worth it to reach out to your school’s financial-aid advisors to learn more about what options are available.

Loans are another way to cover the cost of college, although they do have to be repaid. It is recommended to exhaust all federal loan options before considering a private loan. Private loans are not subsidized or guaranteed by the federal government.

There are other caveats around loans, too. Direct Subsidized Loans don’t accrue interest while you’re in school, but Direct Unsubsidized Loans start accruing interest as soon as the loan is disbursed. And Direct PLUS Loans are for graduate students (or parents of undergraduate students) that can hinge on the applicant’s credit history.

Whichever loan option(s) you choose, don’t borrow more than you need: You’ll thank yourself later when you’re cutting those loan-repayment checks.

Step 5: Explore other ways to pay, including alternative credit options

There’s no reason you should shoulder the cost of college on your own. In addition to financial aid, students can access several other resources to save both time and money on their degree, starting with their employers.

Many companies, in a bid to recruit and retain talent, will offer tuition benefits. Basically, they will help pay for college or pay down your student loans. Just be aware that employer tuition benefits are subject to certain regulations by the IRS. Up to $5,250 can be provided to an employee tax-free per year. Anything more than that is subject to taxation. Check with your company's human resources department to see what options are available.

Another cost-saving avenue is the Prior Learning Assessment (PLA), which awards college credit for eligible life or work experience. PLA is not offered at every school, but it can make a significant impact for students when it is available. At UOPX, for example, every three credits awarded through PLA translate to a savings of nearly $1,200.

Alternative credits are another good option. These are credits earned through alternative, usually online sources like Study.com

and Sophia

. For students looking to accelerate their degree program or knock out some general education courses, this pathway can be very rewarding.

So, can you afford college? With so many financial options out there, you don’t really need a crystal ball to answer it. You just need perseverance and a little creativity to figure out how to make it work.

ABOUT THE AUTHOR

Elizabeth Exline has been telling stories ever since she won a writing contest in third grade. She's covered design and architecture, travel, parenting, lifestyle content and a host of other topics for national, regional, local and brand publications. Additionally, she's worked in content development for Marriott International and manuscript development for a variety of authors. Today, if given a free hour and the choice, she'd still prefer to curl up with a good story.

ABOUT THE AUTHOR

Lilia Ortiz is a writer and artist whose creative journey has been shaped by an appreciation for the beauty inherent in the ordinary. She earned her Bachelor of Arts in English literature from Arizona State University in 2013 and a degree in graphic design from Phoenix College in 2018. Her unique approach to visual design intertwines the tangible with the intangible: She weaves together words, thoughts and ideas with texture, color and pattern. Each result is a testament to the storytelling possibilities that emerge from the convergence of literary and visual arts. She lives in Buckeye, Arizona with her husband, Adam, and dog, Pinto.

This article has been vetted by University of Phoenix's editorial advisory committee.

Read more about our editorial process.

Read more articles like this: