5 financial aid myths debunked

Written by Cassidy Horton

Reviewed by Chris Conway, Director of Financial Education Initiatives and Repayment Management

The financial aid landscape

The subject of financial aid can intimidate even the savviest of college applicants, so it’s no wonder that the topic has given rise to its fair share of myths.

But if you’re going to get federal student aid, it’s important to separate fact from fiction. Here, we debunk five common myths about financial aid.

Myth #1: Only students with high grades and test scores qualify for financial assistance

While it’s true that some scholarships and grants are merit based, many forms of financial aid are need based or awarded for other criteria, such as community involvement, leadership skills, demographics or creative talent.

Federal aid like Pell Grants and the Federal Supplemental Educational Opportunity Grant (FSEOG), for example, are awarded based on exceptional financial need — not grades (although these awards may require you to maintain a certain GPA and completion rate to maintain eligibility for them).

Christine Conway, director of financial education initiatives at University of Phoenix, says this is one of the biggest myths she hears from college students. They automatically assume they won’t qualify for assistance, so they don’t even try.

“Believe it or not, there are many scholarships that don’t have a GPA requirement at all,” Conway says. Even for those that do have a GPA requirement, it isn’t always as strict as you may assume.

If you’re looking for scholarships that aren’t based solely on academic merit, try the following:

- Check with your college’s financial aid office for need-based scholarships and grants.

- Explore online scholarship search engines.

- Look for scholarships offered by professional organizations in your field of study. For example, if you’re planning to pursue a degree in IT, check tech organizations and companies for scholarship opportunities.

- Check with local foundations or civic organizations for scholarships available in your community.

Myth #2: If I have a college savings account, I won’t qualify for financial aid

College savings accounts do not automatically disqualify students from receiving financial aid. Merit-based aid is based on academic or athletic achievement, so it’s not impacted by assets in a 529 plan or other college savings fund. (529 plans can reduce a student’s eligibility for need-based aid, but it’s not always by a significant amount.)

Still, considering the average cost of college tuition in 2023 was $36,436 per year in the U.S., the benefits of starting a 529 plan may outweigh any potential reduction in financial aid. A college savings plan not only decreases a student’s reliance on loans but can also provide tax advantages and potentially higher returns on their savings.

Myth #3: You have to repay all forms of financial aid

Not all financial aid has to be repaid. Consider the following:

- Grants are typically awarded based on financial need or academic achievement.

- Scholarships are based on a variety of criteria, such as athletic or artistic talent, religious affiliation or special accomplishments.

While some forms of financial aid (like student loans) do need to be repaid, options for deferment or loan forgiveness can sometimes apply and assist during hardship to postpone repayment or reduce the amount to be repaid for qualifying students.

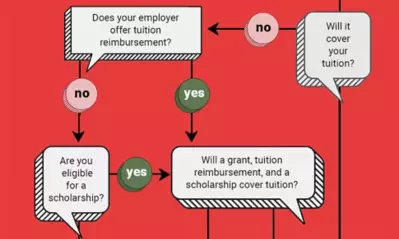

Myth #4: Applying for financial aid is too complicated and time consuming

Although the application process may seem intimidating, there are several ways to simplify the process.

How to speed up the FAFSA process

The FAFSA is the main form you’ll need to complete, and it typically takes less than an hour. The FAFSA form collects information about your family’s finances and determines your eligibility for federal aid.

Many colleges use the FAFSA to award their own aid as well, so taking the time to complete this one form can open up multiple financial aid opportunities for you.

The best way to speed up the application process is to be prepared. Before you start, round up all the documents you’ll need, including tax returns and your FSA ID. Your tax information will pulled directly into the FAFSA, but having your returns nearby may come in handy to answer certain questions.

Also, it may be convenient to ascertain if you'll need contributor information (from a parent or spouse) before you start filling out the form.

How to speed up scholarship applications

When it comes to scholarships, one way to speed up the process is to repurpose essays you’ve already written. Sometimes all it takes is a few tweaks to make an existing essay fit the requirements of other scholarship applications.

Be sure to search for non-essay scholarships as well. These types of scholarships require less time and effort. You can find them on sites like Scholarships.com.

Finally, think about applying for financial aid as a job. “If you spend 10 hours applying for aid and receive $1,000 in scholarships, you’re essentially earning $100 an hour,” Conway says.

Myth #5: If I didn’t qualify for financial aid last year, I won’t qualify this year

Just because you didn’t qualify for federal student aid last year doesn’t mean you won’t qualify this year. Financial aid eligibility is based on a variety of factors, including income, family size, number of dependents in college and other financial obligations.

Because your eligibility factors can change from year to year, it’s essential to fill out the FAFSA every year — even if you didn’t qualify in the past.

Additionally, if you believe you’re eligible for financial aid but didn’t receive it initially, you can request your financial aid be reviewed to have your unique circumstances considered.

Remember, there’s no one-size-fits-all approach to financial aid. Always do your research, ask questions and seek out resources to help you maximize your financial aid opportunities. With the right information and preparation, you can make college a reality without breaking the bank.

ABOUT THE AUTHOR

Cassidy Horton is an academic advisor turned finance writer who’s passionate about helping people find financial freedom. With an MBA and a bachelor’s in public relations, she’s had the pleasure of working with top finance brands like Forbes Advisor and PayPal. She’s also the founder of Money Hungry Freelancers, a platform dedicated to helping freelancers ditch their financial stress. In her spare time, you can find Horton hiking in the Pacific Northwest and cuddling her two cats.

This article has been vetted by University of Phoenix's editorial advisory committee.

Read more about our editorial process.

Read more articles like this: