Understanding tuition at University of Phoenix

Written by Laurie Davies

Reviewed by Chris Conway, Director of Financial Education Initiatives and Repayment Management

As one of the pioneers of online education and a continued prominent provider of online degrees, University of Phoenix understands that students want to get down to the business of achieving their educational goals — without all the financial twists and turns of rising tuition and hidden fees. That’s why understanding tuition at University of Phoenix is so important. How valuable is the degree, and what will it cost?

The short answer is this: Tuition at University of Phoenix is $398 per credit for undergraduate programs and certificates, and $698 per credit for most graduate programs. The university offers fixed tuition pricing, meaning your cost per credit won’t increase over time. For working adults, this predictable pricing helps eliminate surprises and supports long-term planning.

Read on to discover more about costs, plus the many time- and money-savings opportunities that exist for eligible students.

Tuition at University of Phoenix

At a time when costs are rising, UOPX students can count on one fixed, flat tuition rate from the moment they enroll until the day they graduate. We call it our Tuition Guarantee® commitment. Students can call it peace of mind.

Depending on degree level, tuition per credit at University of Phoenix is:

| Tuition per credit |

|---|

|

$398*

|

|

$698**

|

|

$810

|

*Cost per credit applies to both associate and bachelor’s degrees as well as undergraduate certificate programs.

**MAEd and MSN degrees, as well as master’s certificate programs, have a lower cost per credit. Get more detail on each program page at phoenix.edu/degrees.

Learn more about UOPX’s cost of attendance (COA).

Resource fees

In addition to tuition at University of Phoenix, there is one resource fee per course.

| Fees per course |

|---|

|

$170

|

|

$195

|

|

$205

|

This one resource fee per class covers books, digital materials, supplies and equipment. Again, look to the COA for University of Phoenix to learn more about what to expect.

Resource fees are mandatory and encompass course electronic textbooks and materials, the University Library, the eBook collection, math labs, programming software, and the Centers for Mathematics and Writing Excellence.

Is University of Phoenix affordable for working adults?

University of Phoenix was designed with adult learners in mind — 76% of students work while attending school. Fixed tuition pricing, transfer-friendly credit policies and employer alliances help reduce overall costs and make earning a degree more affordable and achievable.

Compare UOPX costs with those of other institutions

No one likes surprises when it comes to their tuition. That's why the University offers affordable, upfront pricing. For example, see how the Bachelor of Science in Business and Master of Business Administration programs stack up tuition-wise to other colleges***:

| Phoenix | |

|---|---|

|

Tuition rate

|

$398

|

|

Typical credits per course

|

3

|

|

Resource fee

|

$170

|

|

Estimated cost per course

|

$1,364

|

|

Total program length

|

120 cr.

|

|

Length of course

|

5 wks

|

|

Tuition guarantee promise

|

Yes

|

Data pulled on March 24, 2025

[1]Source of data: For each institution, the data are publicly available in multiple locations, including Academic Catalogs, Program pages, Tuition and fees pages, and syllabi. All data are publicly available on the websites.

Certain licensure programs and coursework in other degree programs may have additional fees. Please check with your advisor or course catalog for additional info.

Tuition is based on number of credit hours per course. Courses are typically 3 credits, but can range from 1-6 credits.

***This data was pulled March 26, 2024. We update this cost comparison at regular intervals, so check back frequently to see how we measure up against the competition. Visit the University’s COA page to learn more.

Ways to save time and money

So, how much is tuition at University of Phoenix? You have to look at more than just the cost of tuition. You also have to consider the potential savings.

The Savings Explorer™ tool can help students discover how their work, life and school experiences might help them save money based on how other students saved. Additionally, federal student aid can help students cover tuition at University of Phoenix.

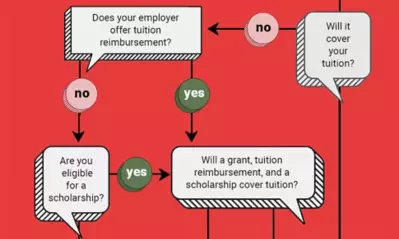

Here are a few of the ways students can pay for tuition at University of Phoenix and potentially save time and money on their degree:

- Scholarships: Starting with their first course, every new, qualifying UOPX student will be awarded a scholarship, applied over a set number of courses.

- Transfer credits: As a transfer-friendly University, UOPX accepts eligible college credits from more than 5,000 accredited institutions. We can even request your transcripts at no cost to you (when possible).

- Prior Learning Assessment: Students with on-the-job training, workplace certifications, or relevant and eligible life experience can apply for college credit through our Prior Learning Assessment (PLA). For every three credits earned, undergrad students can graduate five weeks faster and save almost $1,200 in tuition.

- Federal financial aid: For many students, reaching academic goals could require some level of federal assistance. In general, federal grants are need-based and loans are need-based and non-need-based.

Some employers offer employer tuition benefits, which help students save money while gaining skills that help directly in their job.

Associate degree students who transfer into UOPX can save $144 on every course with UOPX’s special tuition rate. And active-duty service members in the U.S. Armed Forces and their family members are eligible for a lower military tuition rate.

“We try to make education as affordable as we can,” Mohler says. “We do our part so students can do what they came to do — pursue their educational goals.”

Evaluating the investment

Of course, a college degree never guarantees a job, a promotion or a salary increase. Any number of variables — including geography, job growth with a chosen industry, and an individual’s experience, initiative and previous job performance — help determine these outcomes.

University of Phoenix has aligned its degree programs to career-relevant skills with this in mind. As students develop and master these skills, they can showcase them as they go. Specific skills are learned course by course and on display to employers or potential employers through the posting of digital badges on social and career profiles. This helps students get value from their degree before they even graduate.

At the end of the day, that’s what tuition at University of Phoenix offers: an education and peace of mind.

Read more articles like this:

ABOUT THE AUTHOR

A journalist-turned-marketer, Laurie Davies has been writing since her high school advanced composition teacher told her she broke too many rules. She has worked with University of Phoenix since 2017, and currently splits her time between blogging and serving as lead writer on the University’s Academic Annual Report. Previously, she has written marketing content for MADD, Kaiser Permanente, Massage Envy, UPS, and other national brands. She lives in the Phoenix area with her husband and son, who is the best story she’s ever written.

ABOUT THE REVIEWER

As Director of Financial Education Initiatives and Repayment Management, Chris Conway works with departments across the University to provide resources that allow students to make more informed financial decisions. She is also an adjunct faculty member for the Everyday Finance and Economics course at the University, and she chairs the National Council of Higher Education Resources College Access and Success Committee. Conway is committed to helping college students make the right financial decisions that prevent future collection activity.

This article has been vetted by University of Phoenix's editorial advisory committee.

Read more about our editorial process.