University of Phoenix 101: Everything you need to know

Written by Elizabeth Exline

Getting your degree is supposed to be the hard part, not deciding where to get it. But for those of us who can’t even come down firmly on what to have for dinner, figuring out which university is the right one can feel as monumental as taking your first statistics class.

Why is it so hard? Because you don’t know what you don’t know.

"Ninety-five percent of the questions we get are about time and money," observes Chris Gloor, vice president of enrollment at University of Phoenix (UOPX).

If you’re considering enrolling at UOPX, you’ll understandably want a clear idea of what your investment will be. But there are other concerns that are likely at the back of your mind, too. Or worries that you can’t quite figure out how to give voice to.

From the history of the university to enrollment questions you didn’t know you had, here’s the scoop on everything UOPX.

What is University of Phoenix anyway?

University of Phoenix is an institution designed to meet the unique needs of adult students. While this may sound like an obvious idea today, it was virtually unheard of when the University opened in 1976.

At that time, UOPX’s founder saw how adult learners could spend six to 10 years earning a degree, and he recognized an opportunity to do things differently.

The idea was simple: Getting a degree would still require self-discipline and hard work, but the process behind it could and should (and did) become far more accessible.

While this process has evolved over the decades, UOPX today stands out as a pioneer of online learning.

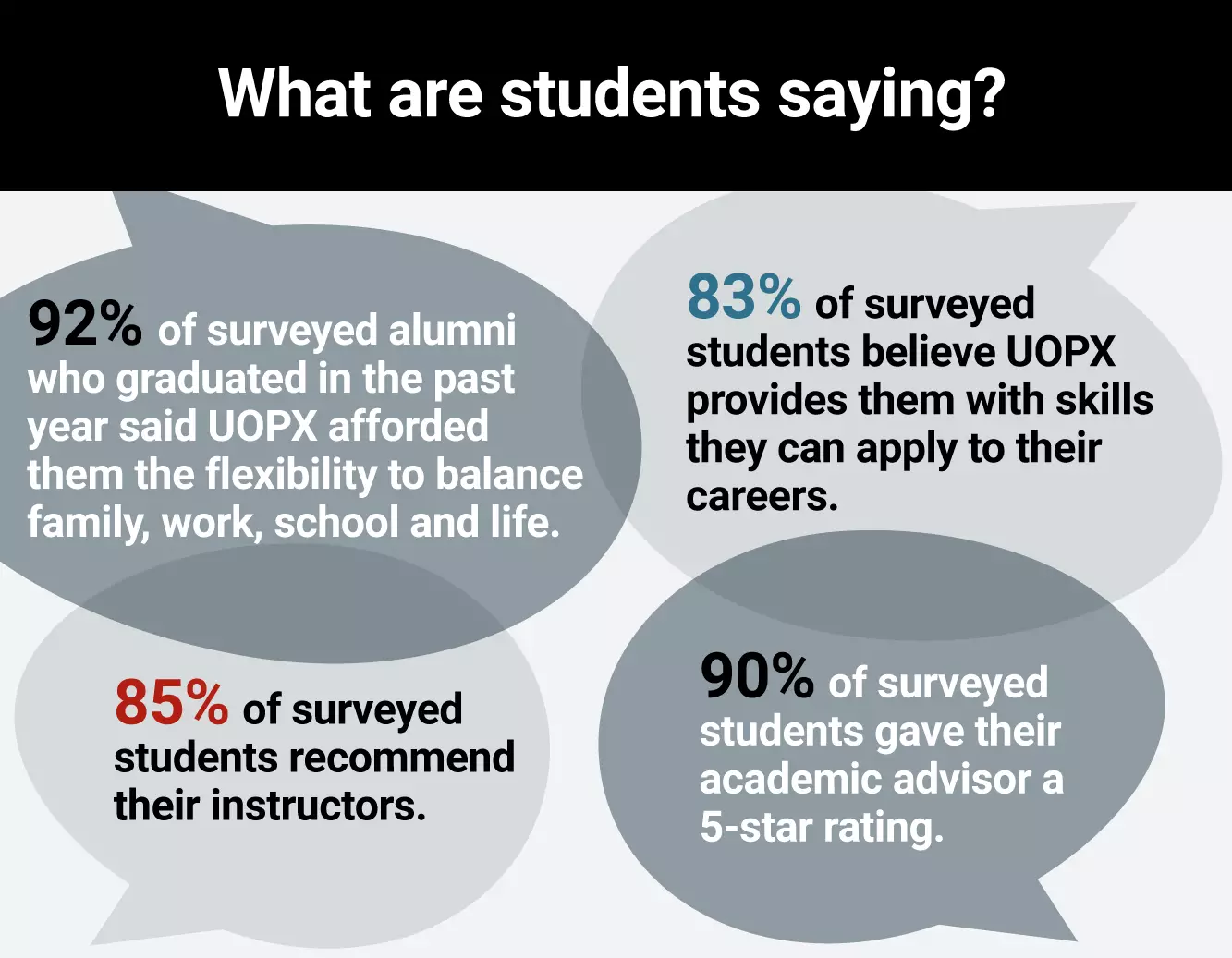

University of Phoenix Survey Results

- 92% of surveyed alumni who graduated in the past year said UOPX afforded them the flexibility to balance family, work, school, and life.

- 83% of surveyed students believe UOPX provides them with skills they can apply to their careers.

- 85% of surveyed students recommend their instructors

- 90% of surveyed students gave their academic advisor a 5-star rating.

What are online classes like at University of Phoenix?

Online college is designed for students who are motivated, self-disciplined and work well independently. That doesn’t mean, however, that you’re on your own. UOPX students can look forward to collaborative opportunities with their peers and one-on-one connections with experienced faculty, all on a schedule that accommodates their other responsibilities. They also have access to a support team up to 20 hours a day, five days a week, plus academic counselors who are committed to student success and have earned a 5-star rating from 90% of surveyed students.

Lessons are posted at set times, and deadlines for assignments are provided ahead of time. Students can then access lessons whenever it’s convenient for them in order to meet their assignment deadlines.

This method has been so fine-tuned for effectiveness, in fact, that 92% of surveyed alumni who graduated in the past year said UOPX afforded them the flexibility to balance family, work, school and life.

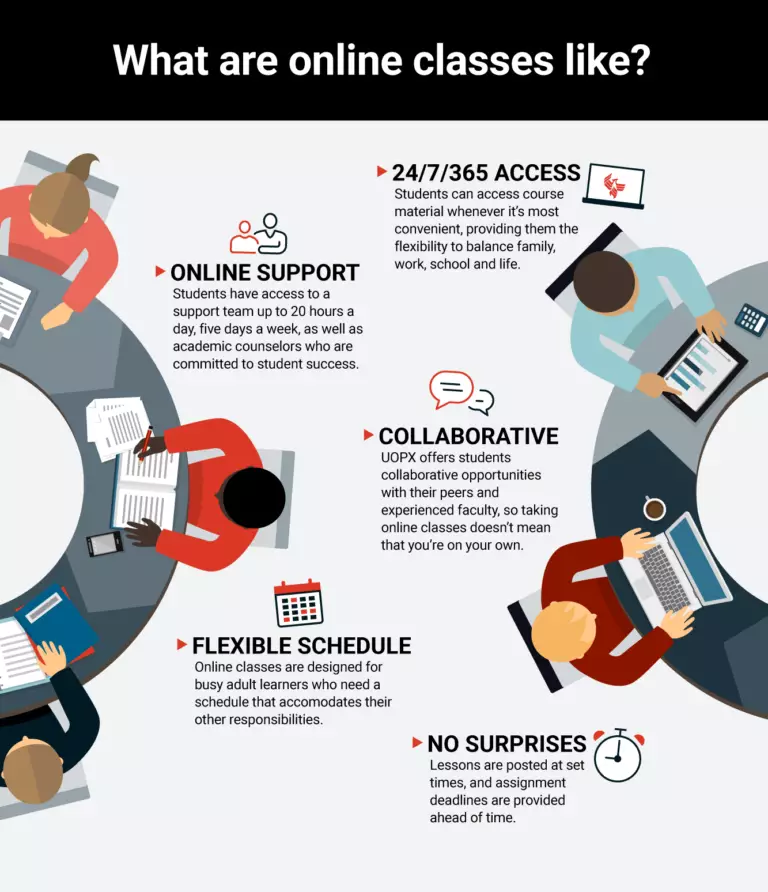

- 24/7/365 Access

- Students can access course material whenever it’s most convenient, providing them the flexibility to balance family, work school and life.

- Online Support

- Students have access to a support team up to 20 hours a day, five days a week, as well as academic counselors who are committed to student success.

- Collaborative

- UOPX offers students collaborative opportunities with their peers and experienced faculty, so taking online classes doesn’t mean that you’re on your own.

- Flexible Schedule

- Online classes are designed for busy adult learners who need a schedule that accommodates their other responsibilities.

- No surprises

- Lessons are posted at set times, and assignment deadlines are provided ahead of time.

How is University of Phoenix different?

Let us count the ways:

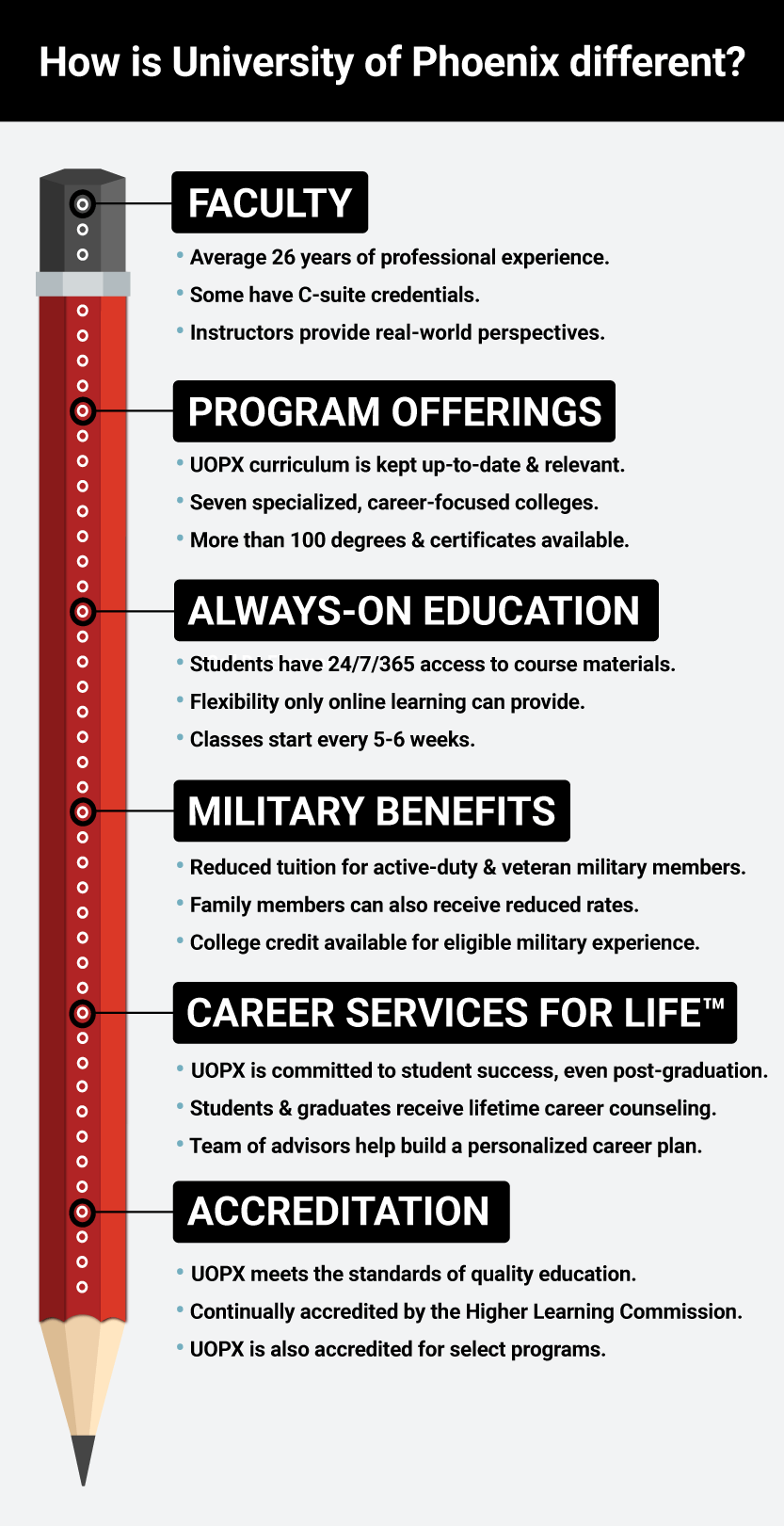

Faculty

Faculty members average 26 years of professional experience, some of them with C-suite credentials, which means students learn from industry leaders. Plus, these faculty bring a hands-on perspective that students can apply toward their work. No wonder 85% of surveyed students recommend their instructors.

Program offerings

Curriculum at UOPX is rooted in real-life results with many degree programs offering a certain level of customization via certificates. Advisory councils comprised of leaders in fields like IT, healthcare and business eet periodically to review industry needs and trends, providing valuable insights that help us keep our programs relevant. In fact, 83% of surveyed students believe UOPX provided them with skills and knowledge they could immediately apply to their careers.

With seven specialized, career-focused colleges, University of Phoenix offers more than 100 degree and certificate options, 90% of which are in growing fields. In addition to associate, bachelor’s, master’s and doctorate degrees, UOPX offers 40+ certificates in business, education, healthcare and more, plus continuing education for teachers. The University also offers professional development courses that are non-credit and self-led in fields such as digital marketing and healthcare for those looking to upskill.

In response to a shifting workforce, UOPX continues to innovate. The University launched badges for specific offerings (select MBA and nursing courses) as a way to quickly convey the skills demonstrated by a student.

UOPX also helmed the development of skills-mapped courses using labor market insights and data from Lightcast, an organization that provides labor-market analysis. Skills-mapped courses align with specific job-ready skills based on job postings. Best of all, you’ll add these skills to your resumé every five to six weeks — not after graduation.

Always-on education

UOPX students enjoy several advantages that accompany the school’s approach to online learning. One of these is the 24/7/365 access students have to course materials. Another is the sequential structuring of courses: Students take one course at a time with classes starting every five to six weeks. That translates to up to 20 opportunities a year to begin a bachelor’s degree and up to 18 to start a master’s. Yet another is professional development courses, which are self-led and non-credit and enable employees to quickly and effectively upskill. Such agility speaks to both UOPX’s commitment to its students and industry alliances.

Military benefits

University of Phoenix offers active-duty and veteran military members reduced tuition rates and, in some cases, resource- fee waivers. College credit is also available for eligible military (and life) experience.

But service members don’t make their sacrifices alone. UOPX has implemented offering military rates to family members of active-duty and veteran military. This is not necessarily common among universities, but UOPX feels that it is the right thing to do.

Career Services for Life®

University of Phoenix is committed to student success, even after graduation. That’s why active students and graduates receive lifetime access to career counseling at UOPX.

What does that look like exactly? It means you have a team of advisors dedicated to helping you build a personalized career plan you can stick with, from resumé reviews to interview prep to one-on-one career coaching.

This is no small thing. Outside career coaching can cost over $200 an hour. At UOPX, it’s built into your degree at no added cost — for life.

Accreditation

Accreditation is a guidepost on the path to determining whether an educational institution meets the standards of a high-quality education. University of Phoenix has been continually accredited by the Higher Learning Commission (HLC), www.hlcommission.org, since 1978. Select programs at UOPX also receive programmatic accreditation; an additional level of external peer evaluation and quality assurance that applies to specific programs.

Honors programs and recognitions

- Faculty

- Average of 26 years of professional experience

- Many have C-suite credentials

- Instructors provide real-world perspectives.

- Program offerings

- UOPX curriculum is kept up-to-date & relevant.

- Seven specialized, career-focused colleges.

- More than 100 degrees & certificates available.

- Always-on education

- Students have 24/7/365 access to course materials.

- Flexibility only online learning can provide.

- Classes start every 5-6 weeks.

- Military Benefits

- Reduced tuition for active-duty & veteran military members.

- Family members can also receive reduced rates.

- College credit available for eligible military experience.

- Career services for life

- UOPX is committed to student success, even post-graduation.

- Students & graduates receive lifetime career counseling.

- Team of advisors help build a personal career plan.

- Accreditation

- UOPX meets the standards of quality education.

- Continually accredited by the Higher Learning Commission.

- UOPX is also accredited for select programs.

Students at UOPX have a variety of options to celebrate their academic excellence. While a dedicated honors program is not available, students can graduate “with honors” or “with distinction” based on their program and overall GPA. The acknowledgment appears on their University diploma and official transcript.

Those enrolled in an associate or bachelor’s program are eligible to graduate:

- Cum laude: With a program GPA of 3.70 to 3.84

- Magna cum laude: With a program GPA of 3.85 to 3.94

- Summa cum laude: With a program GPA of 3.95 to 4.00

Those enrolled in a master’s degree program are eligible to graduate “with distinction” when they achieve a program GPA of 3.90 or higher.

Honors societies, meanwhile, are also available to students in certain fields of studies. Entry requirements vary by organization.

Enrolling: What do real students want to know?

The enrollment team fields a lot of questions from prospective students. Here’s what you should know.

Is application the same thing as enrollment?

Nope! The application process is essentially an information-gathering process to get into a given program, Gloor explains. You’re under no obligation to attend UOPX if you apply but doing so enables the enrollment team to start identifying ways it can save you — yep, you guessed it — time and money. Plus, the application process is free.

Ready for even less commitment? Then simply submit a request for information.

Will my credits transfer?

It depends. Your previously attended school credits are as individualized as you are. Each student transcript, in other words, is different. So, UOPX offers pre-evaluations for prospective students where academic counselors review your unofficial transcript to see what credits may transfer, saving you (again) time and money.

No, but we do want to help. That’s why the University works with Revive IT to provide refurbished laptops at a discounted price.

After a student registers for class, he or she is provided a code to receive $100 off a laptop through Revive IT, which brings the total cost down to only a few hundred dollars. The laptop comes with Microsoft 365 already loaded, and the device meets all hardware and software requirements for UOPX courses.

Since a computer is an education expense, students can even use Federal Financial Aid refund dollars to purchase one.

Does University of Phoenix grant credit for work experience?

In the right instances, yes. Prior Learning Assessment (PLA) is one way prospective students can earn college credit. After applying to the University, a student can provide either a portfolio of work or essays on approved topics to be evaluated for potential credit.

For every three credits earned through PLA, students save nearly $1,200 in tuition and shave five weeks off their degree program. (Hello, time and money.) The best part? On average, 65% of UOPX undergraduates are eligible for PLA credits.

Another option is a competency-based (CB) degree. Ideal for students with professional experience and expertise, this offering ties credits to demonstrable skills. The more you know, the quicker you can progress to new skills and subjects, making your degree not only an expedited experience but one with real-world benefits: You focus on learning what you need to know for your career.

Are SAT or ACT scores required?

No. UOPX understands that adult learners may not have access to old scores and does not require taking these tests for admission.

How about GMAT or GRE scores?

No again. However, there are some baseline requirements for certain programs. You have to be an RN to enter the Bachelor of Science in Nursing program, for example. And to enroll in a graduate program, you do need to have a bachelor’s degree under your belt.

How much does a UOPX education cost?

As with determining your transfer credits, assessing the cost of your program is a highly individualized process. And at UOPX, enrollment representatives will help prospective students find a way to save as much as possible. (UOPX alone offers 10 different ways to save time and/or money!)

UOPX is competitively priced compared to other universities. Here are some other ideas to lower your overall costs. Learn more through the University of Phoenix tuition comparison chart.

There are also misconceptions around who’s eligible for financial aid, Gloor says. For those students who do have demonstrable financial need, the Federal Pell Grant is an option. There are Scholarships that are available at UOPX as well as other scholarships available elsewhere. Additionally, some loans are available to students regardless of how high their income may be, for example.

At UOPX, scholarship opportunities are expanding. Beginning with a student’s first course, every qualifying new student will be awarded a scholarship, regardless of one’s financial situation or GPA. New and transfer students, in fact, can each apply for a scholarship worth up either $1,000 or $3,000.

UOPX is committed to making education affordable for its students in other ways, too. UOPX offers fixed tuition, meaning students pay a flat rate from the moment they enroll to the day they graduate from their program.

Another way to save money? Employer benefits. UOPX has formed alliances with multiple organizations to offer affordable education and tuition assistance is sometimes available from certain companies. Additionally, alternative credit providers such as Study.com offer students the option to earn transferrable credits.

What's the matriculation process like?

This is the process by which you become a student at UOPX. Your official transcripts from other colleges you may have attended are sent to the University and any degree applicable transferrable credits are applied toward your program. Once your transferrable credits are applied your financial aid will get adjusted accordingly once awarded.

While Gloor says most students enroll via the UOPX website they can also take advantage of a New Student Q&A Webinar, which is a complimentary orientation designed to answer any and all outstanding questions so students are prepared for the first day of class.

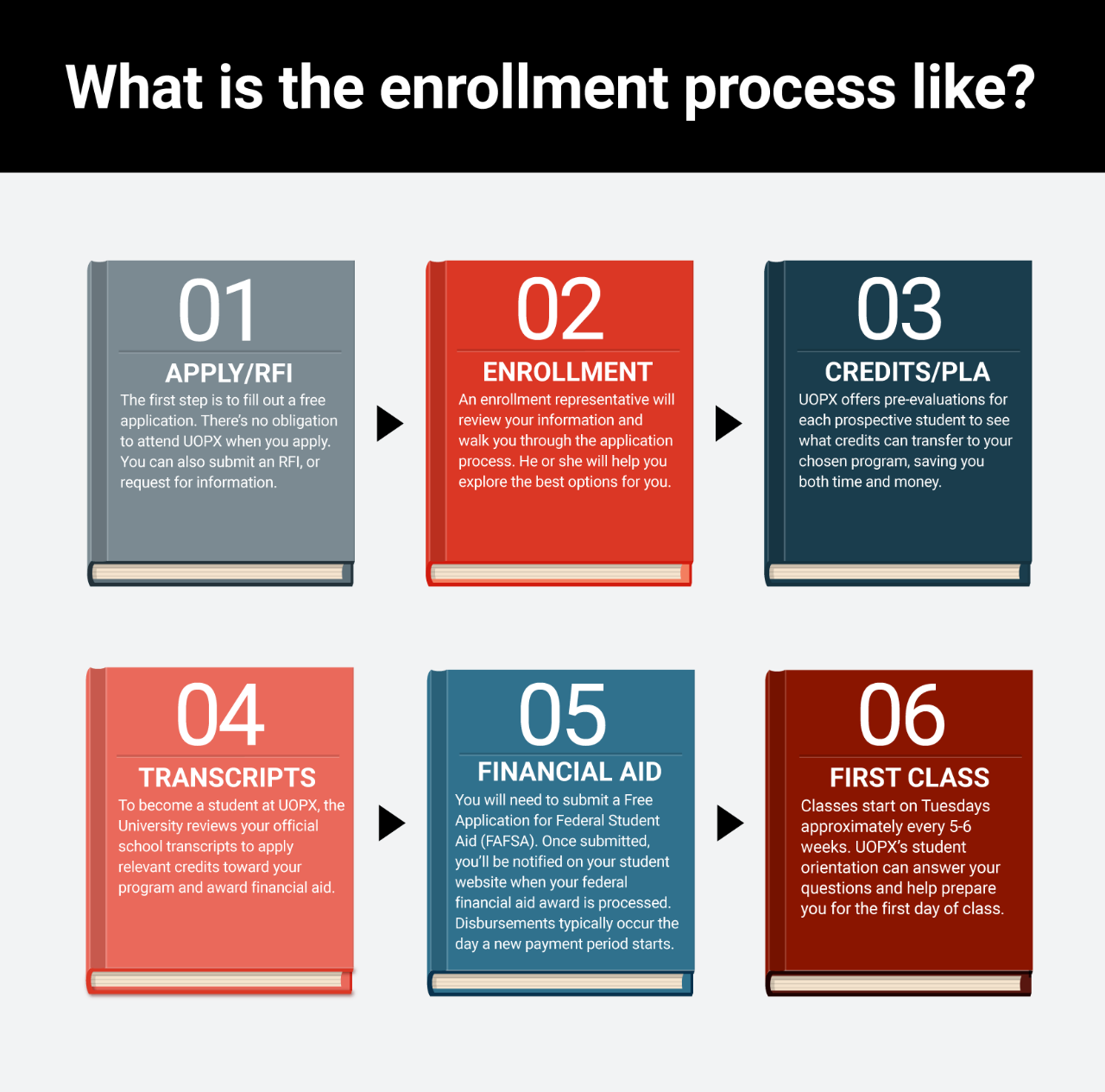

1. Apply/RFI

The first step is to fill out a free application. There’s no obligation to attend UOPX when you apply. You can also submit an RFI, or a request for information.

2. Enrollment

An enrollment representative will review your information and walk you through the application process. He or she will help you explore the best options for you.

3. Credits/PLA

UOPX offers pre-evaluations for each prospective student to see what credits can transfer to your chosen program, saving you both time and money.

4. Transcripts

To become a student at UOPX, the University reviews your official school transcripts to apply relevant credits toward your program and award financial aid.

5. Financial Aid

You’ll be notified on your student website when your federal financial aid award is processed. Disbursements typically occur the day a new payment period starts.

6. First Class

Classes start on Tuesdays approximately every 5-6 weeks. UOPX’s student orientation can answer your questions and help prepare you for the first day of class.

When can I start?

UOPX offers start dates designed to meet your schedule. Classes start on Tuesdays approximately every five to six weeks, so all the paperwork has to be shared and processed by the preceding Friday.

"Students are a bit surprised they can get everything done that quickly," Gloor observes.

How does UOPX respond to the unique needs of underrepresented communities?

The University of Phoenix is proud to welcome students from all walks of life. Half of the student population identifies as African American, Asian/Pacific Islander, Hispanic or Native American/Alaskan. And 66% of students are women.

As a result, UOPX has developed its curriculum and accessibility to meet the needs of a diverse and dynamic student body. Additionally, it offers a robust Student Organization program.

"The Recognized Student Organization program provides a sense of belonging and support for students as they balance academic, professional, familial and personal responsibilities," explains Jelisa Dallas, Program Manager for RSOs and Educational Equity at UOPX.

In layman’s terms, an RSO is a group of students with something specific in common. This might be a professional association, an academically focused interest group or a philanthropic group. Dallas plans to expand this offering to include ethnic affinity groups in the near future.

In addition to networking, these groups offer opportunities to develop a variety of skills like leadership, professional development, community engagement and financial literacy.

"The social capital — effective collaboration through shared culture to meet a common goal — offered through our organizations make for a well-rounded student equipped for new opportunities," Dallas explains.

How do you accommodate accessibility needs?

The University’s Student Accommodations Office works with individuals who have medical conditions, mental health challenges or learning disabilities that impact their education. The goal? To discuss options for removing barriers to their learning experience.

Common accommodations are:

- Extra time to complete assignments or exams

- Sign language interpreters

- Access to a quiet testing area

- Note-taking assistance

Students can also access multiple assistive technology resources, such as read-aloud functions for online texts, dictation options through Microsoft 365 and the Life Resource Center at UOPX.

During the 2023 fiscal year, the University accommodated nearly 16,000 students, underscoring our commitment to empowering all students on their educational journeys.

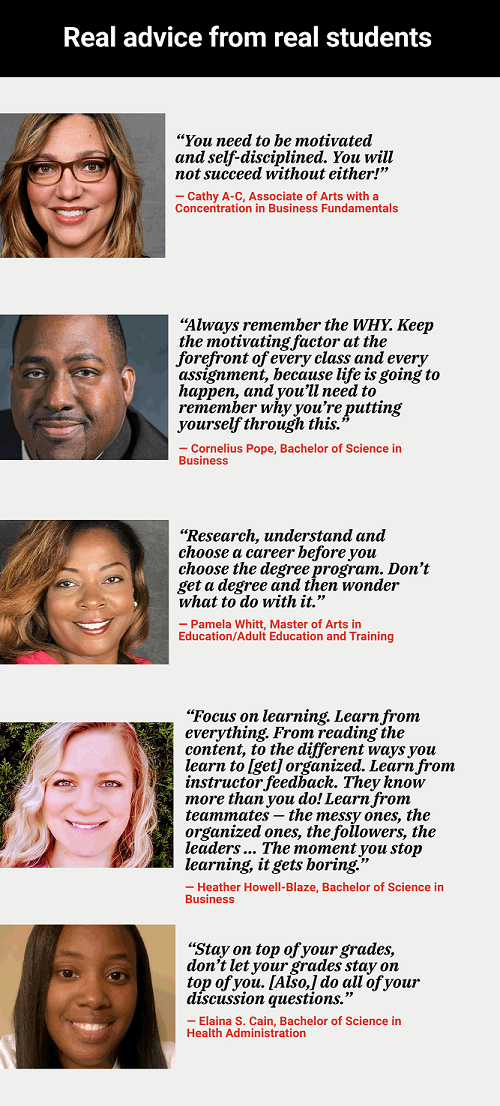

Real advice from University of Phoenix students

No matter how much you research, and no matter how many questions you ask, sometimes there’s just no substitute for jumping in and learning along the way. Here, we share advice from those who have gone before (aka UOPX students).

“You need to be motivated and self-disciplined. You will not succeed without either!”

— Cathy A-C, Associate of Arts with a Concentration in Business Fundamentals

“Always remember the WHY. Keep the motivating factor at the forefront of every class and every assignment, because life is going to happen, and you’ll need to remember why you’re putting yourself through this.”

— Cornelius Pope, Bachelor of Science in Business

“Research, understand and choose a career before you choose the degree program. Don’t get a degree and then wonder what to do with it.”

— Pamela Whitt, Master of Arts in Education/Adult Education and Training

“Focus on learning. Learn from everything. From reading the content, to the different ways you learn to [get] organized. Learn from instructor feedback. They know more than you do! Learn from teammates — the messy ones, the organized ones, the followers, the leaders ... The moment you stop learning, it gets boring.”

— Heather Howell-Blaze, Bachelor of Science in Business

“Stay on top of your grades, don’t let your grades stay on top of you. [Also,] do all of your discussion questions.”

— Elaina S. Cain, Bachelor of Science in Health Administration

ABOUT THE AUTHOR

Elizabeth Exline has been telling stories ever since she won a writing contest in third grade. She's covered design and architecture, travel, lifestyle content and a host of other topics for national, regional, local and brand publications. Additionally, she's worked in content development for Marriott International and manuscript development for a variety of authors.

This article has been vetted by University of Phoenix's editorial advisory committee.

Read more about our editorial process.

Read more articles like this: